Sometimes, these can be entirely justified.Īs a rule of thumb, the more risky and/or niche an investment category is, the higher its management fees will be and hence the higher its operating expenses will be. This is because the funds are largely managed by computer algorithms with very little human input.Īt the other end of the scale, there are investment funds with very high operating expense ratios. Why the total expense ratio (TER) can be misleadingĪ fund’s TER is generally best viewed as a useful guideline rather than a hard-and-fast indicator of a fund’s overall value.įor example, passively-managed funds (often known as index trackers) will almost inevitably have a low operating expense ratio. This means that investors should look at the TER to see what the fees are likely to be over the long term. Once the market stabilises, the management fees will almost certainly be increased. This creates a more favourable NER, but only for that period. If a fund is operating in a competitive market, its managers may choose to waive/reimburse some of their fees.

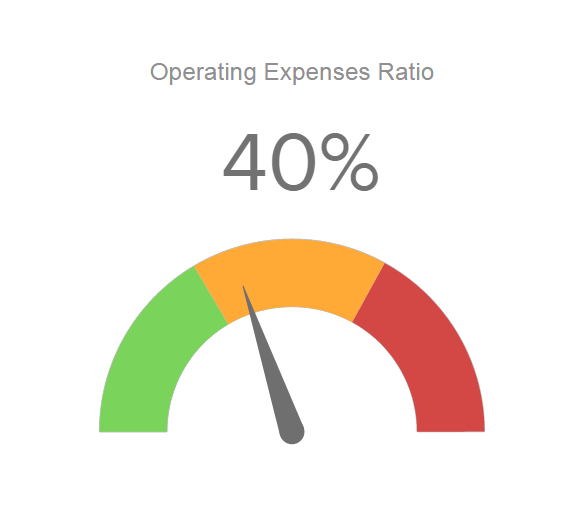

These are driven by the market, but unlike wages/salaries for regular employees, however, they tend to be highly discretionary. With actively managed funds (as opposed to index trackers), the single-biggest cost by far is management fees. Others are discretionary – at least to some extent. Some of these costs are fixed (such as taxes). These are: payments to managers, distribution fees and general expenses. The reason this matters is because most investment funds have three main areas of expenditure. This means it is only a valid reflection of what investors paid during that specific accounting period. The NER, by contrast, takes into account any discounts that have been applied during the relevant accounting period. It, therefore, shows what investors should expect to pay if all charges are applied at standard rates. The total expense ratio (TER) is more reliable than the net expense ratio (NER) because it shows the fund’s standard operating costs before any discounts are applied. Why total expense ratio (TER) is more reliable than net expense ratio (NER) Funds with safer investment profiles should be on the lower side and vice versa. As a rule of thumb, the TER should be between 1% and 1.25%. The total expense ratio (TER) is a convenient way of forming an initial judgement on whether an investment fund is worth its management fees. Investors, therefore, need a way to judge whether or not an investment manager (or management team) delivers enough overall value to justify these costs. Hiring someone else to help you manage your investments increases the cost of investing. They can do so themselves or they can hire someone else to help them. There are basically two ways investors can manage their portfolios. Why the total expense ratio (TER) matters The standard total expense ratio (TER) is, however, generally the one to which investors should pay the most attention. The net expense ratio excludes any expenses that are recouped, recovered, reimbursed or simply waived.īoth ratios have their uses.

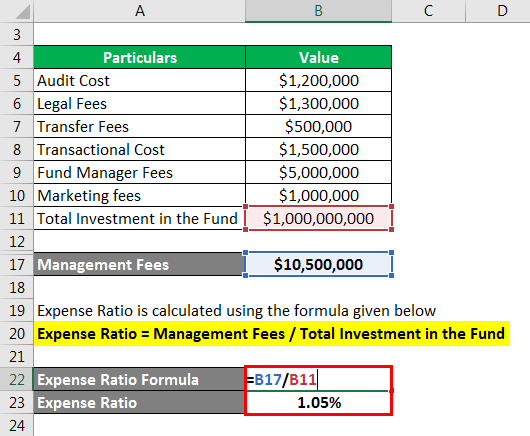

Many funds will also provide the net expense ratio (also known as the after reimbursement expense ratio). This calculation gives the gross expense ratio. Asset value is the average value of all assets held by the fund. TER = Total Operating Expenses (OPEX) / Value of Total Fund Assetsīrokerage and trading costs are excluded from operating expenses. The basic approach to calculating the expense ratio is: The expense ratio is one way to determine if a fund is offering value for money. It is also sometimes known as the management expense ratio (MER), the operating expense ratio (OER) or the before reimbursements expense ratio (BRER). The expense ratio is the ratio of an investment fund’s operating expenses to its assets.

0 kommentar(er)

0 kommentar(er)